Businesses in Low Income Areas and Neighborhoods of Color Across Massachusetts Receive Fewer Loans Than Peers in 2021; Local Lenders Lead in Year Two of PPP

February 05, 2024

Boston, MA – Businesses in low-income tracts across the Commonwealth receive less than their respective percentage of loans, both in terms of the number of loans and the total dollar amount of loans, according to a report based on 2021 data released today by the Partnership for Financial Equity.

Small Business Lending Matters was prepared by the Chicago-based Woodstock Institute as part of a multi-year research partnership with the Partnership for Financial Equity. Some of the key information and findings in the report include the following:

•In the state as a whole,12.3 percent of businesses are in low-income tracts, and those businesses receive 7.9 percent of reported small business loans of $100,000 or less.

•In Gateway Cities, 42.3 percent of businesses are in low-income areas with 28.8 percent of loans going to those businesses.

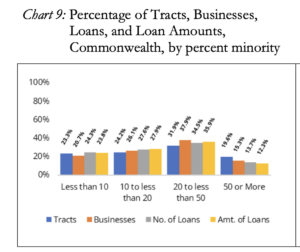

•Nearly 20 percent of businesses across the state are located in neighborhoods that are majority minority but those businesses receive 13.7 percent of the number of loans and 12.3 percent of the amount of dollars loaned.

•In Boston, businesses are less likely to be located in census tracts that are majority minority. For example, over 48 percent of census tracts in Boston are majority minority, but only 30 percent of business are located in those tracts.

•The same pattern does not hold true for Gateway Cities though. 43 percent of census tracts in Gateway Cities are majority minority, and 45.5 percent of business are located in those tracts.

•The data show some financial institutions among the top lenders making substantially larger loans to businesses than the overall average loan amount. For example, the overall average loan amount for all lenders in the Commonwealth was just under $17,000, but the average for Citizens Bank was nearly $29,000, and for Eastern Bank the average was about $24,600. In some instances, not only are lenders making larger loans overall, their loans to businesses in low- and moderate-income (LMI) census tracts are as large or larger than the loans they make to businesses in middle- and upper-income tracts.

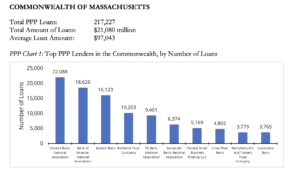

•The report includes a section on lending in year two of the Paycheck Protection Program (PPP) and highlights the importance of lenders with a local branch presence in Massachusetts. Citizens Bank, Bank of America, Eastern Bank, Rockland Trust, TD Bank and Santander were the top six PPP lenders in 2021 to Massachusetts employers.

•County-specific data show a wide variety of lenders in the top spots with Cape Cod Five and Cooperative Bank of Cape Cod the top PPP lenders in Barnstable County; Baycoast Bank the second leading lender in Bristol County; Eastern Bank topping Essex County; Greenfield Savings in Franklin County; bankESB in Hampshire County; and Rockland Trust in Plymouth County.

About Partnership for Financial Equity

Partnership for Financial Equity was established in 1990 to bring together community organizations and financial institutions to affect positive change in the availability of credit and financial services across the Commonwealth by encouraging community investment in low- and moderate-income communities and communities of color. We are funded through the financial support of member financial institutions, community development organizations and others. Our Board of Directors consists of an equal number of representatives from leading community organizations and financial institutions.

About Woodstock Institute

At Woodstock Institute, our mission is to advance economic justice and racial equity within financial systems through research and advocacy at the local, state, and national levels. Woodstock Institute envisions a society where all people experience economic security and prosperity.